The election of Aung San Suu Kyi is a useful reminder that change and progress is possible even in the most apparently sclerotic societies. Whatever the combination of external pressure and internal dynamics, the notion that there is a parliament in the country formerly known as Burma, that there are elections that matter, and that long-time pro-democracy dissident Aung San Suu Kyi won a seat, is a reminder to a casual observer that the status quo can evolve. Perhaps if change is possible in Myanmar, it is possible here as well.

After a week of watching the partisan hostilities surrounding the Supreme Court's oral arguments on Obamacare, Matt Bai's article in the New York Times magazine revisiting the failed "grand bargain" that might have ameliorated our continuing budget crisis suggests both how close the sides came to a viable agreement. Notwithstanding lingering questions about whether the President Obama changed the terms of the deal at the last moment and whether Speaker John Boehner could have delivered the votes of his restive caucus, it seems clear that Obama and Boehner fundamentally understand the urgency of addressing our long-term budget challenges before market forces make such a resolution far more difficult.

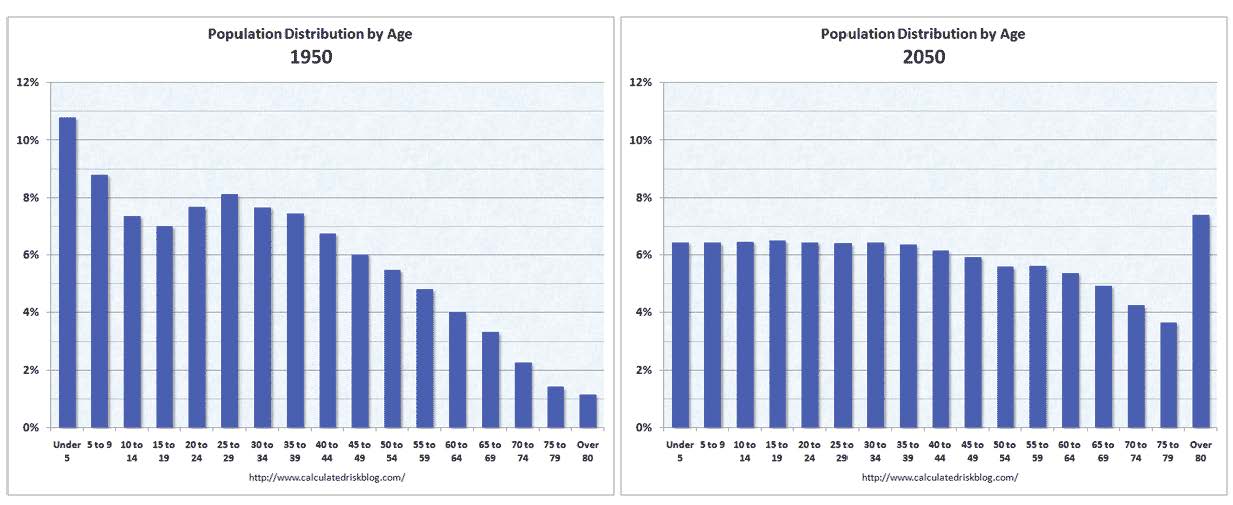

The intractability of our budget problems are illustrated in this dynamic graphic that illustrates the changes over time in the population distribution by age of the United States from 1950 to 2050. As shown here in the snapshots of the beginning and end of that century long period, the age distribution by 2050 has a far greater share of the population in the post-65 retirement years, compared to the beginning of the century when the population distribution reflected a larger working age population supporting their retired parents and grandparents.

These demographic trends tell much of our budget story. The steady aging of the population and the declining share of the population that are in their economically active years demands that difficult choices be confronted. With an aging population and with increasing longevity, and a declining share of the population in their economically productive years, the costs per retiree are growing steadily and demanding a steadily increasing share of national resources.

When the Social Security system was created in the 1930s, average longevity was less than the retirement age of 65. That is to say that the average American at the time died before they were eligible to receive benefits. In 1950, there were sixteen workers paying into the system -- which remains in large measure a pay-as-you-go system where current payroll taxes pay for current retiree benefits -- compared to 2.8 workers by 2010. Today, with longevity approaching 80s and the retirement age still at 65 for most Americans, simply to cap retiree and health spending at a constant percentage of GDP would require some combination of extending the age of eligibility, means testing and/or changes to the benefits formula.

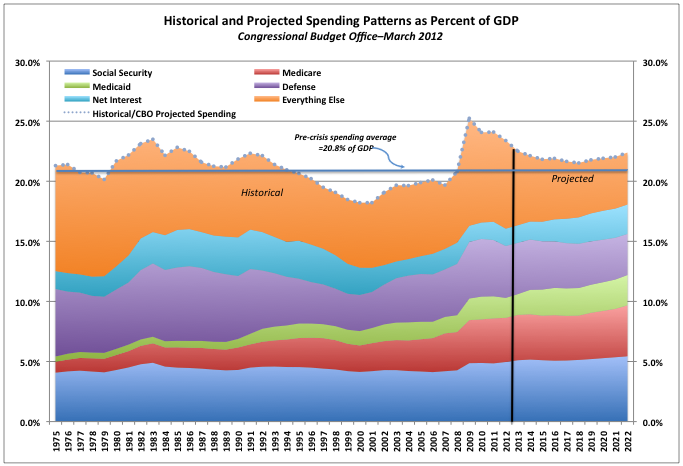

The graph below illustrates the pattern of federal spending over the past several decades, and projected for the next decade by the Congressional Budget Office. As illustrated here, over the past decades, the cost of core entitlements has grown steadily to usurp a growing share of federal spending. As this graph suggests, if federal spending were to be capped at its pre-financial crisis average since the mid-1970s of 20.8 percent of GDP, five categories of spending -- Social Security, Medicare, Medicaid, Defense and Net Interest -- will steadily squeeze out all other areas of entitlement and discretionary spending. By 2022, Everything Else is squeezed out, falling 57 percent from its historical average of 6.4 percent of GDP to 2.7 percent of GDP.

The Obama-Boehner negotiations illustrate the challenge to the two political parties -- and particularly to the ability of the party leadership to bring along their rank and file -- in navigating their way to a long-term budget solution. The urgency of controlling our destiny sooner rather than later is illustrated in the growing Net Interest share of the federal budget over the coming decade. The growth in Net Interest shown here reflects optimistic assumptions by the Congressional Budget Office of only gradual increases in federal borrowing costs, with the 10-year treasury barely reaching 5 percent over the coming decade.

It is notable that Net Interest, currently 1.5 percent of our national GDP, peaked in 1991 at 3.3 percent of GDP in 1991 in the wake of Reagan-era deficit. However, our public debt currently stands at four times the amount in 1991, while current net interest costs reflect today's absurdly low interest rates that are around one-fourth of what they were back then. We do not have to face a Greece-like scenario threatening loss of market access, skyrocketing interest rates and default for our failure to control our financial destiny to wreck havoc on our national budget and politics. All it would take is for economic activity to rebound and investors regain comfort with global debt and equity markets, and we can reasonably expect to face a scenario with substantially higher federal borrowing costs. For example, should interest rates return to 1991 levels, the interest costs of our current level of public debt would rise from the current 1.5 percent to closer to 7 percent of GDP, well more than the share of national income consumed today by Medicare, Social Security or defense.

The problem, of course, is that everyone in Washington wants to solve the nation's fiscal imbalances by placing the burden on the back of someone else's constituency. Democrats, as New York Mayor Michael Bloomberg pointed out in an op-ed this week, are living an illusion in their suggestion that tax hikes on the rich alone can do anything meaningful to solve our fiscal problems. For their part, Republicans have demonstrated no appetite for compromise on budget solutions. W. counsel John Yoo argued in an op-ed this week that regardless of the outcome of this week's Supreme Court arguments, salvation can only come through complete dominance of both branches of Congress as well as the executive branch.

House Budget Committee Chairman Paul Ryan is one of few in Washington who has proven himself willing to grapple with the entitlement nettle, however vague his budget proposals might be. Democrats only undermine their own credibility as they attack Ryan's budget proposals with accusations that Republicans are throwing the elderly under the bus. The fact is that one way or the other, the future will be different from the past, the question is when our political leaders will face up to the challenges. And the longer they wait, the more painful the required changes will be.

Congressman Ryan, like President Obama, rejected the Simpson-Bowles Commission recommendations. The failure of the president to provide leadership on the issue was particularly puzzling as the Commission report came in the wake of the off-year 2010 elections in which Democrats -- and the president in particular -- were soundly rebuked. One does not need the benefit of hindsight to wonder how the president's political advisors at the time could have believed that he could negotiate a better deal with Republicans than what the Simpson-Bowles Commission put on the table.

Looking back, one has to imagine that either the president underestimated the severity of the budget challenge or overestimated his ability to persuade his Republican opposites. Neither conclusion is comforting. However, the portrait painted by Matt Bai in the president's negotiation with the Speaker suggest the latter, that the president is prone to overestimate his negotiating ability, as Bai's account suggests that the president had a deal within reach, but changed the terms at the last minute.

For his part, Paul Ryan's rejection of the Simpson-Bowles Commission recommendations as a member of the Commission led directly to the Commission's failure. Had Ryan supported that balanced plan, he likely would have brought with him the two more votes necessary to force an up-or-down vote in Congress, and the entire history of the fiscal debate and the debt ceiling travesty might well have been different.

For Tea Party fellow travelers -- who in Matt Bai's account were an unmovable obstacle to a budget deal even as the president won the acquiescence of Congressional Democrats -- the budget question is fairly straightforward: What is the greater evil, debt or taxes?Both parties would prefer to imagine a world where they dictate the outcome and do not have to compromise on their principles. But we don't have a parliamentary system; the two sides ultimately have no choice but to work together and no one is going to get the outcome that they prefer.

Aung San Suu Kyi's triumph should give us hope that if change can happen in Myanmar, we should set aside our cynicism and insist that the dysfunction and gridlock in our nation's capital not allow our country to risk meandering further down the tracks toward a fiscal and -- societal -- train wreck. President Obama and Speaker Boehner understood the parameters of a solution -- as did the Simpson-Bowles Commission -- and came remarkably close to a deal. The solutions are not difficult to imagine, just the willingness of our leaders to embrace them, and their followers to follow.

?

gi joe jason wu for target collection jason wu jason wu the patriot nick diaz vs carlos condit hall of fame

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.